Countries With the Highest Housing Bubble Risks

With a decade-long bull market and an ultra low interest rate environment globally, it’s not surprising to see capital flock to housing assets.

For many investors, real estate is considered as good of a place as any to park money—but what happens when things get a little too frothy, and the fundamentals begin to slip away?

In recent years, experts have been closely watching several indicators that point to rising bubble risks in some housing markets. Further, they are also warning that countries like Canada and New Zealand may be overdue for a correction in housing prices.

Key Housing Market Indicators

Earlier this week, Bloomberg published results from a new study by economist Niraj Shah as he aimed to build a housing bubble dashboard.

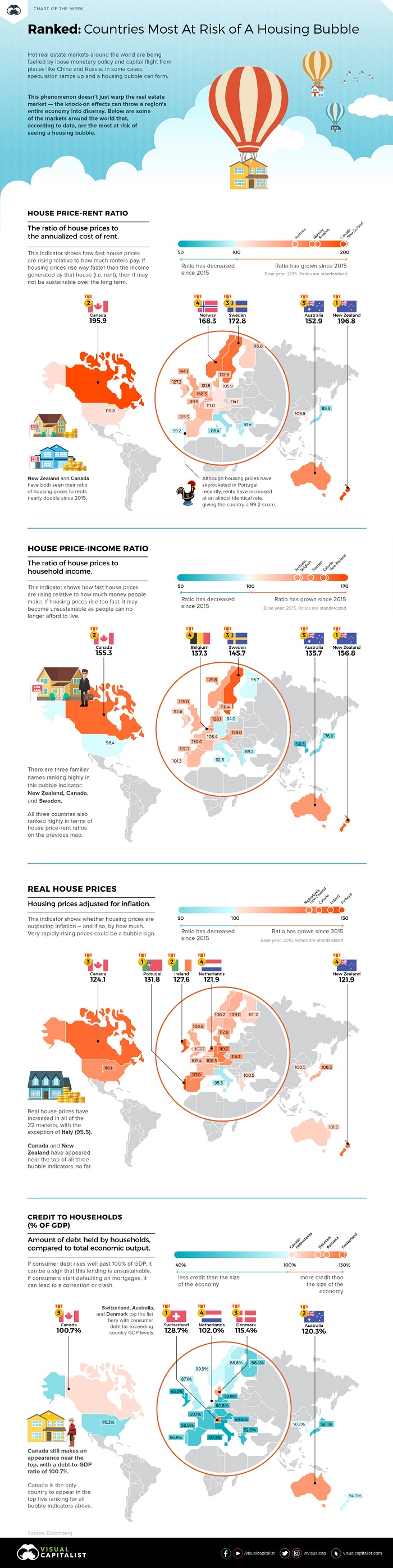

It tracks four key metrics:

- House Price-Rent Ratio

The ratio of house prices to the annualized cost of rent - House Price-Income Ratio

The ratio of house prices to household income - Real House Prices

Housing prices adjusted for inflation - Credit to Households (% of GDP)

Amount of debt held by households, compared to total economic output

Ranking high on just one of these metrics is a warning sign for a country’s housing market, while ranking high on multiple measures signals even greater fragility.

Housing Bubble Risks, by Indicator

Let’s look at each bubble risk indicator, and see how they apply to the 22 countries covered by the housing dashboard.

It should be noted that most of the measures here are shown in an index form, using the year 2015 as a base year. In other words, the data is not representative of the ratio itself—but instead, how much the ratio has risen or fallen since 2015.

1. House Price-Rent Ratio

When looking at housing prices in comparison to rents, there are four countries that stand out.

New Zealand (196.8) and Canada (195.9) have seen ratios of housing prices to rents nearly double since 2015. Meanwhile, Sweden (172.8) and Norway (168.2) are not far behind.

Elsewhere in the world, this ratio is much more in line with expectations. For example, in Portugal—where house prices have skyrocketed over recent years—rents have increased at nearly the same rate, giving the country a 99.2 score.

2. House Price-Income Ratio

There are three familiar names at the top of this bubble indicator: New Zealand (156.8), Canada (155.3), and Sweden (145.7).

In places where rents are lagging housing prices, so are the levels of household income. For how long will people afford to buy increasingly expensive houses, if their incomes continue to lag?

3. Real House Prices

Real house prices have increased in all of the 22 markets, with the exception of Italy (95.5).

For this indicator, there are five markets that stand out as having fast-rising prices: Portugal (131.8), Ireland (127.6), Netherlands (121.9), Canada (124.1), and New Zealand (121.9). The latter two (Canada/New Zealand) have appeared near the top of all three bubble indicators, so far.

4. Credit to Households (% of GDP)

Exceedingly high debt ratios point to a strain on consumer finances – and when finances are strained, the chance of a default increases.

Switzerland (128.7%), Australia (120.3%), and Denmark (115.4%) top the list here with consumer debt far exceeding country GDP levels. However, Canada still makes an appearance in the top five with a debt-to-GDP ratio of 100.7%.

Source: www.visualcapitalist.com

Source: www.visualcapitalist.com

The post Countries With the Highest Housing Bubble Risks appeared first on StoneNews.eu.

4:59 am July 26, 2019

Atieh Pasargad Amethyst International Trade Company ( سنگ پاسارگاد )

Address: Old Qom kashan Road – Omid Stone City – Qom – Iran

Email:

Ali Shafiei – CMO » Ali@pasargadstone.com

Hossein Shafiei – CEO » Hossein@pasargadstone.com

(+98) 912 553 5362

Ali Shafiei – CMO

Chief Marketing Officer

(+98) 912 251 8055

Hossein Shafiei – CEO

Chief Executive Officer

سنگ پاسارگاد – Pasargad Stone All Right Reserved

Designed and Developed by Branex.ir برانکس